Services like Afterpay, Klarna and Zip have been a game changer for many, allowing them to shop for expensive purchases without having to have all the money upfront.

Best of all, unlike credit cards, you can shop without having to pay ridiculous interest rates on your purchases.

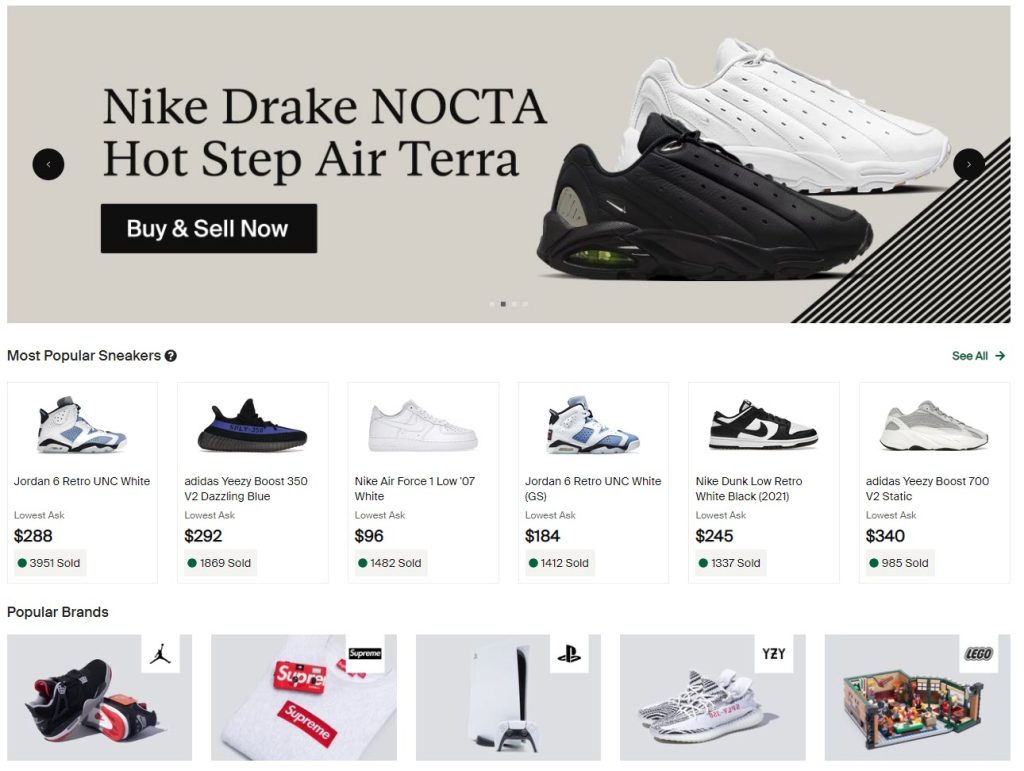

If you want to spread out your purchase on StockX, you may be wondering if they offer any of these ‘buy now, pay later’ services that have become so popular in recent years.

Fortunately, the answer is yes, and StockX offers several. In this article, we’ll cover everything that you need to know!

Does StockX Take Afterpay?

Although StockX offers several different ‘pay later’ services, Afterpay is not one of them.

This means that you will not be able to use Afterpay for any shoes or merchandise that you buy on StockX.

Part of what makes Afterpay great is the fact that they don’t do credit checks, they don’t charge interest, and they allow you to make payments bi-weekly. In fact, the only fees you are charged are if you’re late with your payments. So, if you’re good at managing your money, you can safely split the cost of your StockX purchase over 4 payments, without paying anything extra at all.

Although this would be fantastic for shoppers at StockX, Afterpay unfortunately isn’t offered. However, other similar services are offered that will still allow you to split your purchase into more manageable payments.

What Buy Now, Pay Later Services Does StockX Accept?

Currently, StockX accepts 3 different services that are similar to Afterpay: Zip, Klarna, and Affirm.

Each one of these essentially operates the same – you make your purchase now, and your purchase price is split up into separate payments. You can then make payments over time until your StockX purchase been paid off.

For example, if you bought a $600 pair of shoes and you used a service like Affirm, Klarna or Zip to finance your purchase, you could end up paying $150 each month for 4 months, for example.

Typically, as long as you make all of your payments on time, interest is either extremely low or non-existent. Additionally, most services do not require credit checks or even to have a good credit score.

How do Zip, Klarna, And Affirm Work?

To better understand which service is right for you, let’s look at each one of them in more detail.

As we’ve already discussed, each service works by splitting up your purchase into multiple payments. Where each service can differ is in regards to their fees, interest, and requirements to be approved for financing.

Klarna

Credit Check: Klarna runs a soft credit check to determine eligibility. However, this does not impact your credit score.

Payment Terms: Purchases are split into 4 payments, with one payment occurring every 2 weeks.

Interest: There is no interest on purchases finances with Klarna.

Late Fees: Late fees up to $35 are added if payments are late.

Zip

Credit Check: Zip does not run any credit checks.

Payment Terms: Purchases are split into 4 payments. Payments are made from a linked debit or credit card over 6 weeks – or roughly one payment every 1.5 weeks.

Interest: Zip Pay has no interest.

Late Fees: Zip charges either $5, $7 or $10 depending on the state that you live in.

Affirm

Credit Check: Affirm checks your credit score, but it is not a hard inquiry. This means that prequalifying does not affect your credit score in any way.

Payment Terms: Affirm allows you to split payments into 4 with one payment every 2 weeks. Alternatively, you can pay monthly for 6 months, or monthly for 12 months. For expensive StockX purchases, this makes each payment much lower.

Interest: Affirm charges no interest if payments are split into 4. If making monthly payments over 6 or 12 months, there will be a 15% APR. However, there are no prepayment fees if you want to pay your StockX purchase off early.

Late Fees: Affirm does not charge any late fees.

Is It Worth Using A ‘Pay Later’ Service?

Whether or not it’s worth it to use one of these services depends on your unique financial situation.

If you have the money to spend, it’s usually a good idea to purchase things upfront so you don’t need to worry about them later.

However, if you don’t have the money now, using a service like Afterpay, Klarna, Affirm or Zip usually brings less fees than credit cards.

Additionally, if you are responsible with your money and make all payments on time, many services do not have any additional fees whatsoever. This means that you lose nothing by spreading the payment out – yet you get to keep more of your cash for a longer period of time, in case you need it. Therefore, you really have nothing to lose.

Of course, one of the downsides of credit in general is that some people are prone to spending more than they can reasonably afford – trapping themselves in debt.

So, you need to take an honest, rational look at your situation and determine whether or not purchasing StockX on credit is a good idea.

Conclusion

Unfortunately, StockX does not take Afterpay. However, they take several other similar services that you can use to finance your purchase.

Of course, if you have the money now, you can certainly pay for your goods in full when checking out. If you want to spread your payment out across several months however, Zip, Affirm and Klarna are all great choices to do so.

I hope that you’ve found this article helpful. If you have any other questions about shopping at StockX, please ask them using the comment form below.

Wishing you the best,

– James McAllister